Famous software company Adobe joint the research firm The Diffusion Group to survey the video streamers in US. Here are some interesting finding.

Overal

Among adult video streamers:

- 42% of time spent in front of the television screen at home with either subscription, transactional or free streaming video services. (Ho’s comment: It is pretty impressive provided that it doesn’t include the use of OTT service through mobile devices)

- Among the OTT time in front of the TV, users spent 65% of time on subscription video-on-demand (SVOD), 30% on free streaming (or free video-on-demand, FVOD) and only 5% on transactional streaming services (or transactional video-on-demand, TVOD)

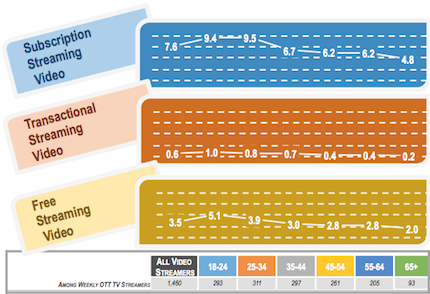

Weekly hours spent watching OTT on a household TV among all adult video streamers, by age

Source: “Streaming Video Survey Analysis,” by The Diffusion Group, January 2016.

Among the three types of consuming model: SVOD, FVOD and TVOD. The survey would some further detailed findings as below.

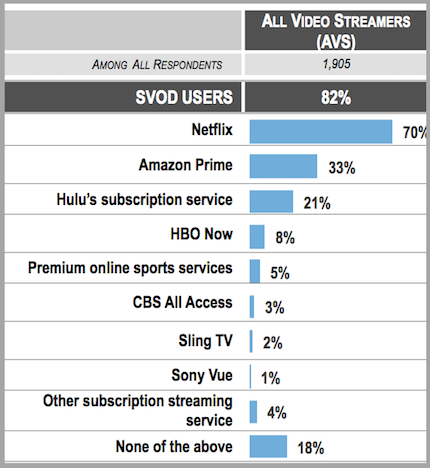

Subscription Video-On-Demand, SVOD

Percent of adult video streamers using online subscription video

Source: “Streaming Video Survey Analysis,” by The Diffusion Group, January 2016.

Ho’s quick comment: Netflix is dominating not only because of its wide range of library together with their home-brew drams which couldn’t find in anywhere else.

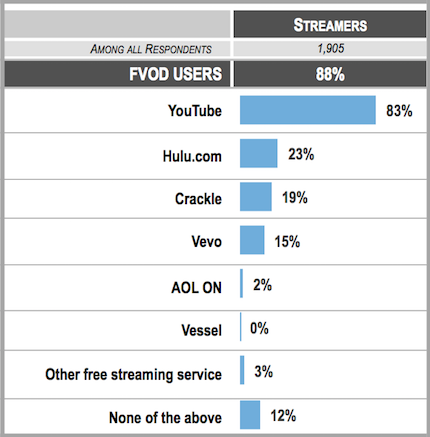

Free Video-On-Demand, FVOD

Percent of adult video streamers using free streaming video

Source: “Streaming Video Survey Analysis,” by The Diffusion Group, January 2016.

Ho’s quick comment: YouTube has the biggest library and at the same time a good integration with its mobile app to “throw” some video from mobile to TV screen.

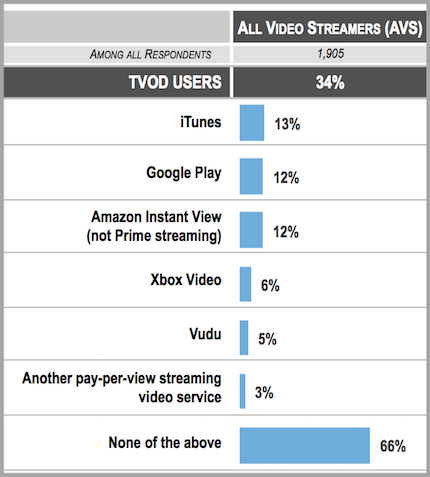

Transactional Video-On-Demand, TVOD

Percent of adult video streamers using transactional streaming video

Source: “Streaming Video Survey Analysis,” by The Diffusion Group, January 2016.

Ho’s quick comment: Only 5% of user do transactional video. Probably this business model simply doesn’t work for TV. User is required to struggle and make payment descision on renting a movie while they just simply want to relax in front of the TV.

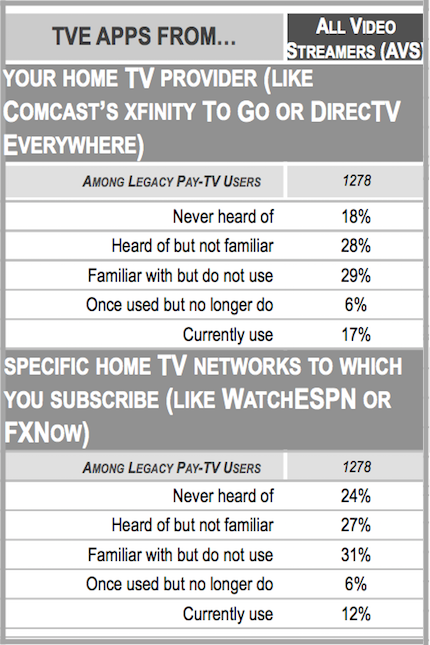

Operators’ and TV Networks’ TV Everywhere solutions

So… How about the TV operators like Comcast and DirecTV, and TV Networks like Fox and ESPN???

Research finds that 17% of OTT users who also have pay-TV subscription would use the apps provided by the operator.

While 12% would use the apps provided by the TV Networks with their pay-tv account.

That doesn’t sound nice but that could be a reason behind. Operator and TV Network would tend to use their TV Everywhere app as a supplementary for user to catch-up with the programs. They would not want to have their subscribers moving away from their traditional channel as their major advertising revenue is still there. You could imagine the operator and TV Networks would not push so hard to promote a TV app.

This is exactly how Asian city like Hong Kong and Singapore being like nowadays where monopoly broadcasters and operators are not so keen to bring OTT or TV Everywhere app on TV.

Familiarity and usage by type of TV Everywhere streaming service

Source: “Streaming Video Survey Analysis,” by The Diffusion Group, January 2016.

Comments by Cheung Chun Ho